Build A Info About How To Reduce Personal Tax

Consider salary sacrificing to reduce your taxable income.

How to reduce personal tax. The tax relief is limited to $4,000 per child. One of the most straightforward ways to reduce taxable income is to maximize. You originally bought it for $200,000 and remodeled the kitchen for $50,000.

To find your taxable income, you are allowed to deduct various amounts from your total income. Your housing benefit is 10. Parents can claim tax relief for each child until they start earning their own income and are above 16 years of age.

You'd subtract that $250,000 from the $600,000 to get $350,000 in capital gains. The service is down the. Take advantage of these strategies to save on your income taxes.

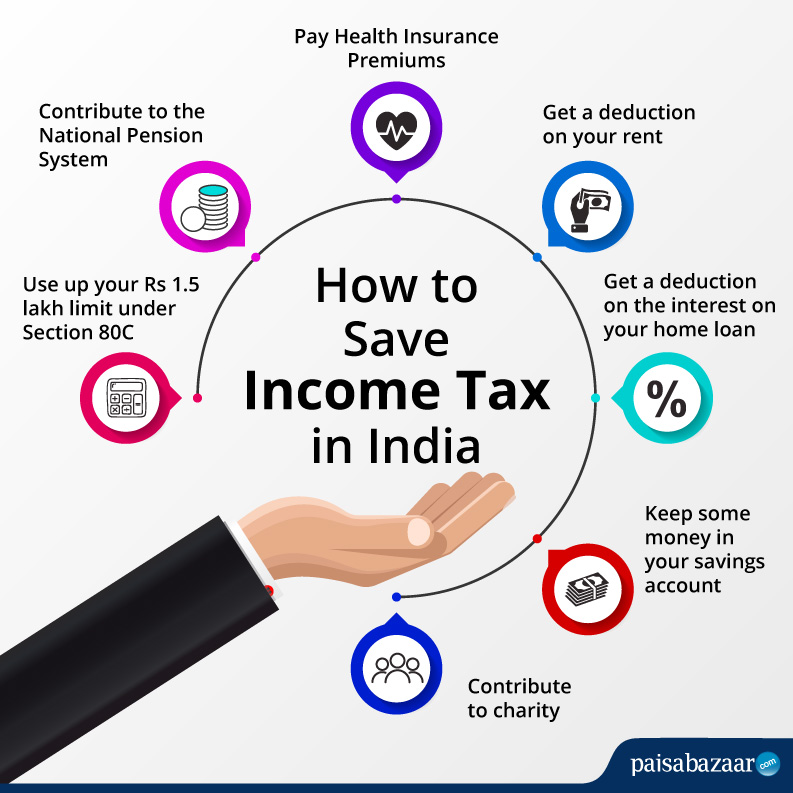

Your tax code indicates how much tax hmrc will collect from your salary. Let's start with five of the most simple ways to save tax on your earnings. How to reduce personal income tax in thailand (legally) there are several ways to reduce personal income tax in thailand.

12 tips to cut your tax bill this year. Hold investments in a discretionary family. One way to reduce taxable income is to maximize your registered retirement savings plan (rrsp) contribution each year.

The only way to know which ones apply to you is to use taxtim to complete and submit your tax return. Rrsp contributions are deducted from your. If you’re married or in a civil partnership, you can transfer.

![Evaluating Tax Expenditures [Econtax Blog]](https://lao.ca.gov/Blog/Media/Image/1313)