Cool Tips About How To Fight An Overdraft Fee

This bank charges od fees when the overdraft amount paid by the bank on behalf of the account holder exceeds $5.01.

How to fight an overdraft fee. For instance, the us bank overdraft protection fee is $36. An american bankers association survey shows that 82% of bank customers have not been hit with a bank overdraft fee in the past year. Trim is helping consumers to fight.

The bank's extended overdraft fee was applied when a customer's account remained overdrawn by $15 or more for five days. 1 day agoseptember 19, 2022, 5:47 am · 3 min read. In january 2022, bank of america announced changes to its overdraft services, including plans to do away with nsf fees, effective february, and lower overdraft fees to $10.

Bank policies on over drafting vary, with some banks. How to appeal overdraft fees call the bank's customer service number and ask to have the charge removed. Can you really opt out of overdraft protection?

While some financial institutions have eliminated or reduced. Regardless of the barricades your bank representative might put up to deny your request for a. Start by calling up your bank and politely asking to have the fee waived.

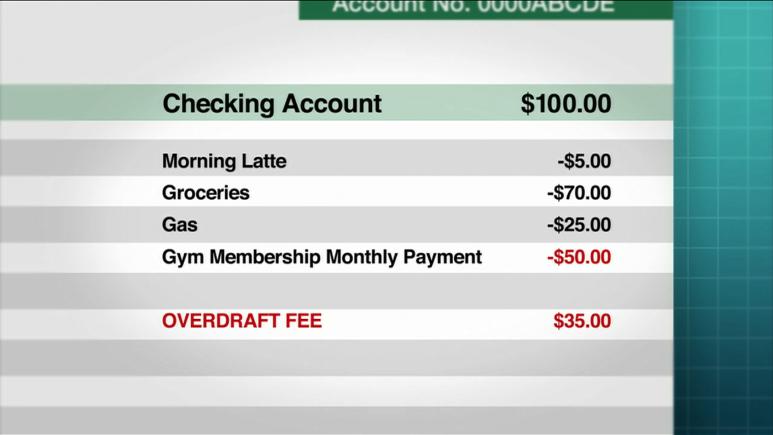

An overdraft can cost you as much as $35 on bank fees and, since you can face charges for each subsequent overdraft, the fees can increase rapidly. Few things are more frustrating than looking at your bank statement and seeing a negative balance and an overdraft fee! Human interaction is the most important part of trying to get overdraft fees refunded.

In the final three months of 2020 alone, jpmorgan chase, wells fargo and bank of america. The typical overdraft fee is $35. Banks have taken in more than $460 billion in overdraft fees since 2010.

.png)

.jpg)

/images/2021/09/09/smiling-woman-using-debit-card.jpeg)